marin county property tax calculator

Falls Church city collects the highest property tax in Virginia levying an average of 094 of median home value yearly in property taxes while Buchanan. Clark County has one of the highest median property taxes in the United States and is ranked 546th of the 3143 counties in order of median property taxes.

Marin County California Property Taxes 2022

The exact property tax levied depends on the county in Virginia the property is located in.

. The median property tax in Clark County Nevada is 1841 per year for a home worth the median value of 257300. Virginia is ranked 29th of the 50 states for property taxes as a percentage of median income. Clark County collects on average 072 of a propertys assessed fair market value as property tax.

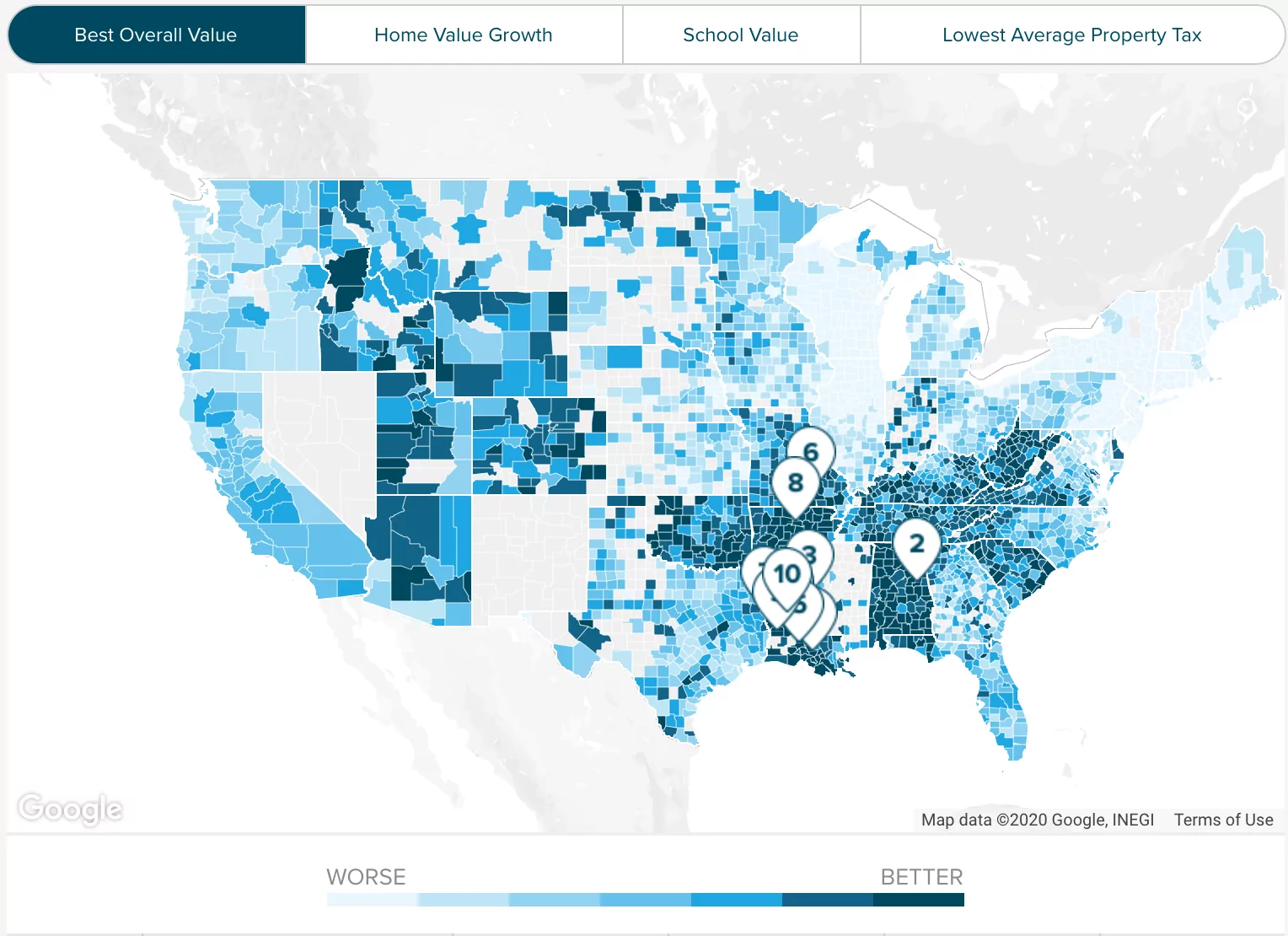

Property Tax By County Property Tax Calculator Rethority

Transfer Tax In Marin County California Who Pays What

California Mortgage Calculator Smartasset

2022 Best Places To Buy A House In Marin County Ca Niche

Property Tax By County Property Tax Calculator Rethority

Transfer Tax In Marin County California Who Pays What

Santa Clara County Ca Property Tax Calculator Smartasset

Property Tax By County Property Tax Calculator Rethority

Property Tax By County Property Tax Calculator Rethority

Marin Wildfire Prevention Authority Measure C Myparceltax

The Property Tax Inheritance Exclusion

Understanding California S Property Taxes

Marin Property Tax Bills Top 1 Billion For First Time Marin Independent Journal

U S Property Taxes Levied On Single Family Homes In 2018 Increased 4 Percent To More Than 304 Billion Attom

In Terms Of Real Estate Values One Marin County Zip Code Leapfrogged Bay Area Rankings Achieved 4 Nationally

U S Property Taxes Levied On Single Family Homes In 2016 Total More Than 277 Billion Attom

Marin Wildfire Prevention Authority Measure C Myparceltax

Property Taxes On Single Family Homes Rise Across U S In 2021 Attom